Trusted by 120,000 teams worldwide

Tailored solutions for finance professionals

Ensure every client interaction is personalized and compliant with a comprehensive CRM made for financial services.

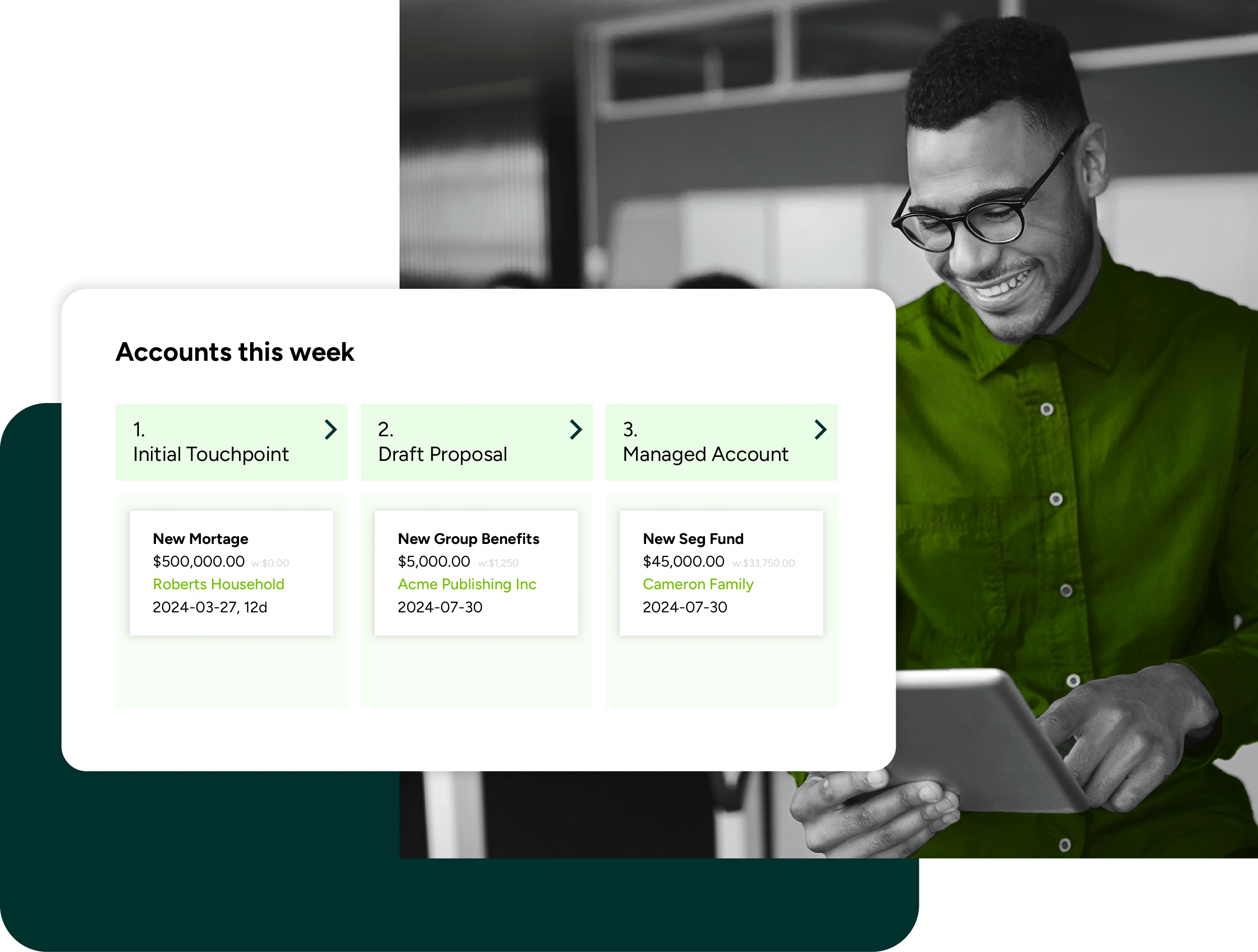

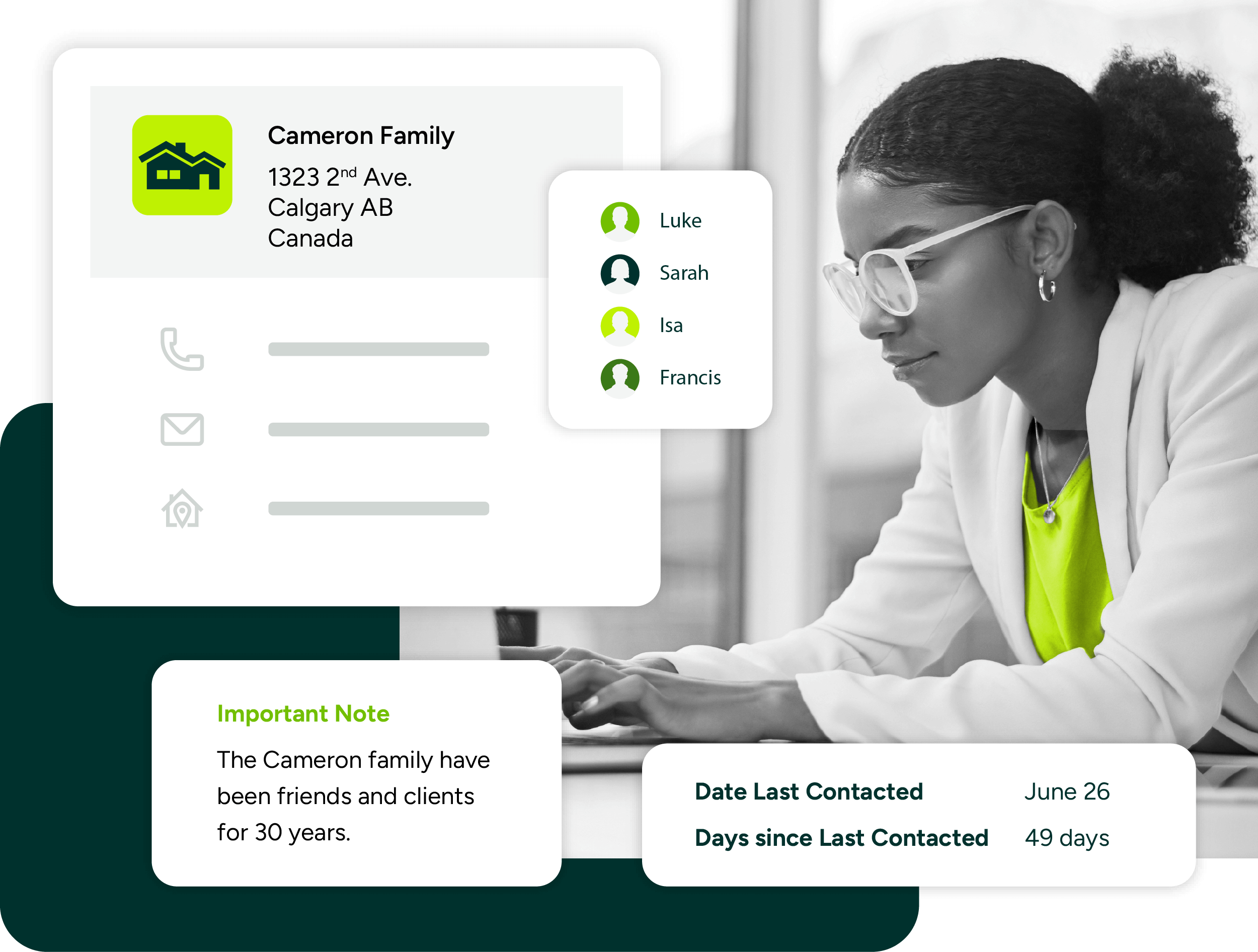

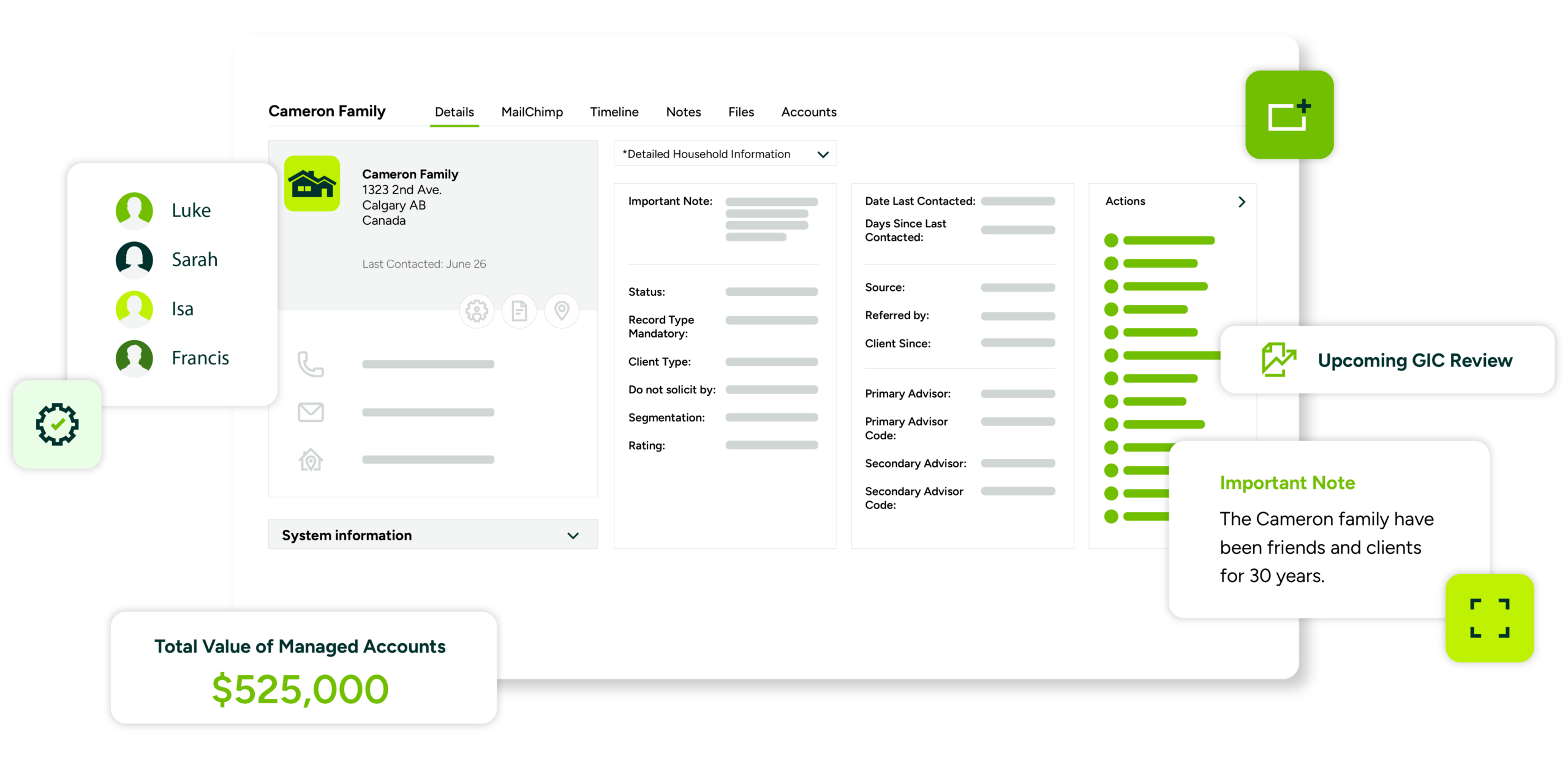

Client relationship tracking

Integration with financial planning tools

Task management and automation

Customizable dashboards and reports

Transform client engagement with smart CRM tools

Maximizer connects your data in one place so you can build stronger client relationships and deliver tailored advice.

Personalized client journeys

Track life events and milestones to offer timely recommendations.

Automate follow-ups based on client interactions and preferences.

Provide proactive service by anticipating financial needs before they arise.

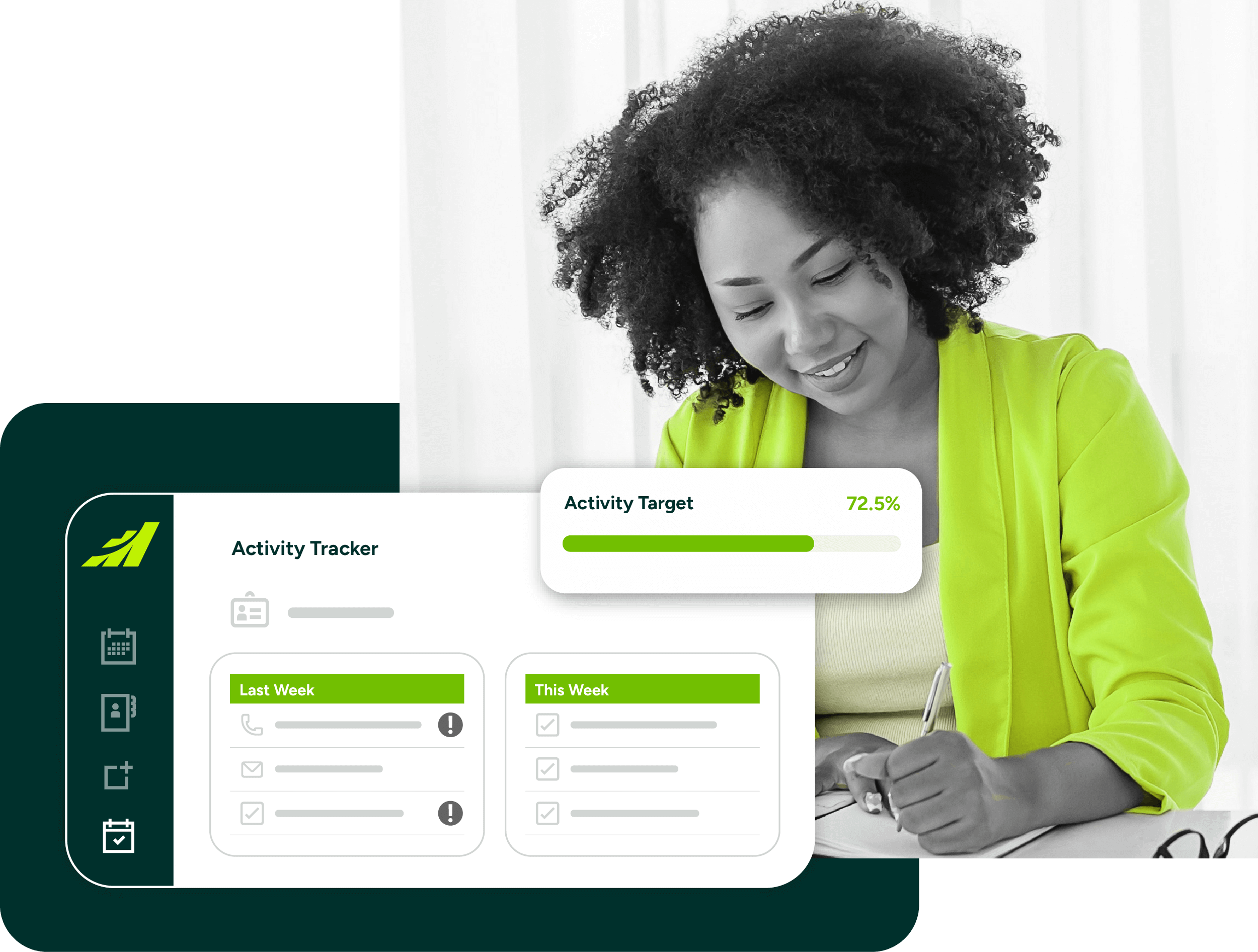

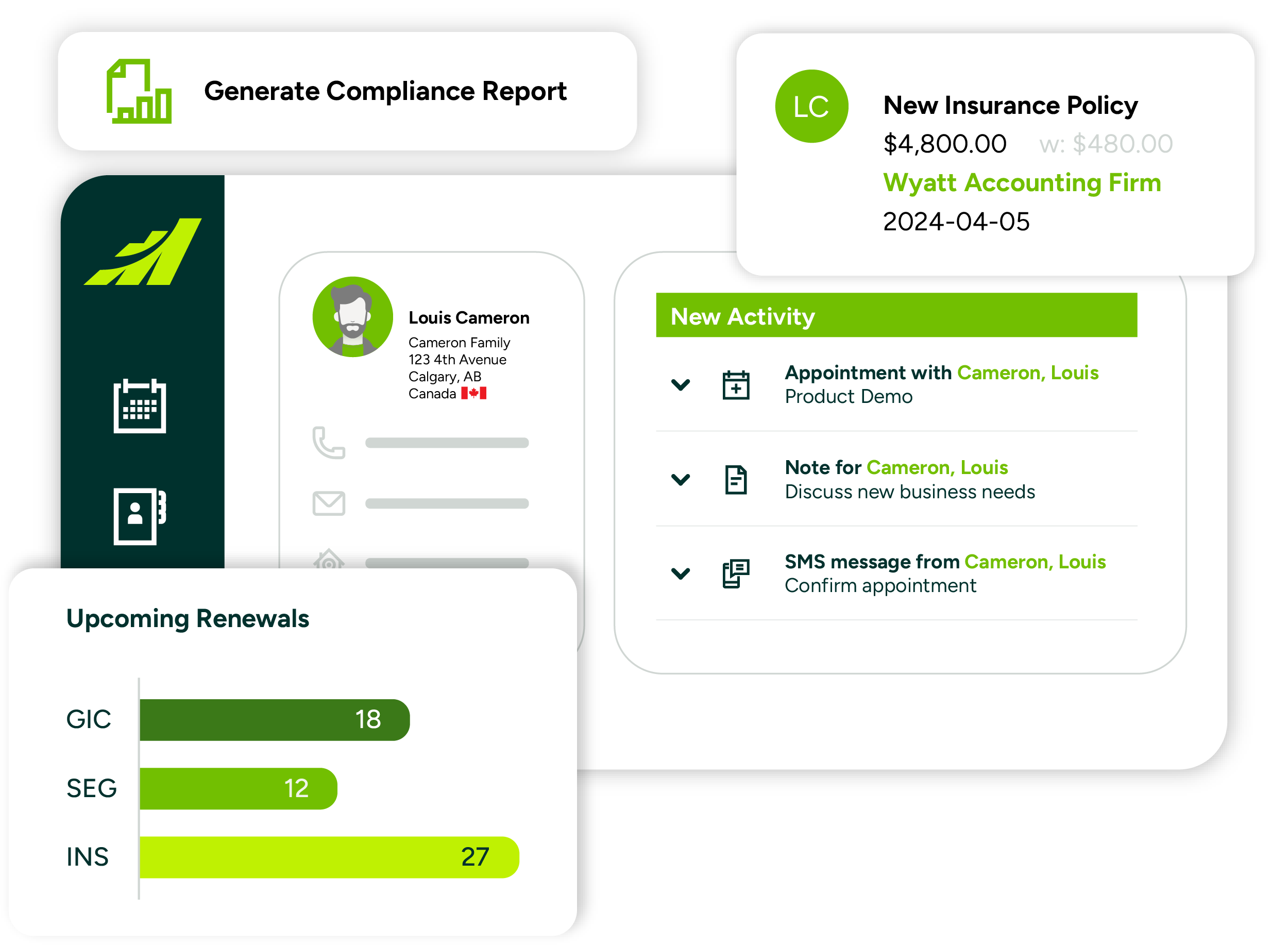

Real-time performance tracking

Monitor revenue trends and financial product performance in dashboards.

Identify opportunities for selling tailored financial solutions.

Set up alerts for key performance metrics to act proactively.

Simplified compliance and risk management

Generate compliance reports with built-in audit tracking.

Ensure data integrity with role-based access and encryption measures.

Reduce regulatory risks with automated documentation and reporting tools.

#1 CRM for financial services

Financial advisors rank Maximizer as the #1 Financial Services CRM on G2, the leading software review site.

Why financial professionals prefer Maximizer

Future-proof your financial services business

Adapt to market changes

Automate compliance updates to ensure adherence to industry standards.

Built in Canada

Regulatory compliance simplified

Maintain accurate records and generate detailed compliance reports.

Data security and privacy

Implement role-based access control to safeguard sensitive data.

Configure your CRM to fit your business needs

Quick and easy onboarding

Get up and running with guided setup and access to training resources.

Companies choose to partner with Maximizer

Learn why people love Maximizer

Top 5 Salesforce Alternatives and Competitors for 2025-2026

Choosing the right CRM can make or break your business growth, but Salesforce isn’t the only option on the market. As organizations evolve, many are seeking alternatives that deliver strong...

When Clients Feel Known: The Quiet Shift Reshaping Advisor Growth

Some days in wealth management move fast: appointments back-to-back, an inbox that never seems to slow, notes waiting to be finished. And yet, the moments that truly shape growth rarely happen in...

Best Credit Union CRMs 2025-2026

As credit unions continue to adapt to the digital expectations of modern members, Customer Relationship Management (CRM) software has become a vital part of growth, service, and compliance...

Try Maximizer Today

Experience a CRM built for financial advisors. Access accurate data, build client relationships, and grow your business with a CRM with industry knowledge.

Frequently asked questions

1. What is the best CRM for financial services?

2. How does a CRM benefit financial advisors?

3. Is Maximizer CRM secure for financial data?

4. Can Maximizer integrate with financial planning software?

5. How can I get started with Maximizer CRM?

Why financial services professionals need a CRM

In the financial services industry, maintaining strong client relationships is key to long-term success. Whether you’re managing investments, insurance policies, or client portfolios, having a reliable financial services CRM ensures that every client interaction is personalized, compliant, and efficient.

CRM for the financial services industry helps firms:

- Enhance client communication and relationship tracking.

- Automate administrative tasks, allowing advisors to focus on clients.

- Ensure compliance with industry regulations.

- Integrate with financial planning tools.

Key features of Maximizer’s financial services CRM

1. Client Relationship Tracking

Manage and track client interactions, investment preferences, and financial goals in one secure platform.

2. Automated Workflows and Task Management

Automate routine processes such as follow-ups, reminders, and approvals to improve efficiency and reduce manual workload.

3. Secure Document Storage and Compliance Tools

Stay audit-ready with secure, encrypted document storage, ensuring compliance with industry regulations.

4. Integration with Financial Planning Tools

Connect with financial modeling and wealth management software for real-time data insights.

5. Customizable Dashboards and Reporting

Get real-time reports and analytics tailored to your firm’s key performance indicators.