Trusted by 120,000 teams worldwide

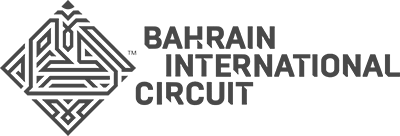

A complete solution for modern financial firms

Explore the modules that power better performance across your network.

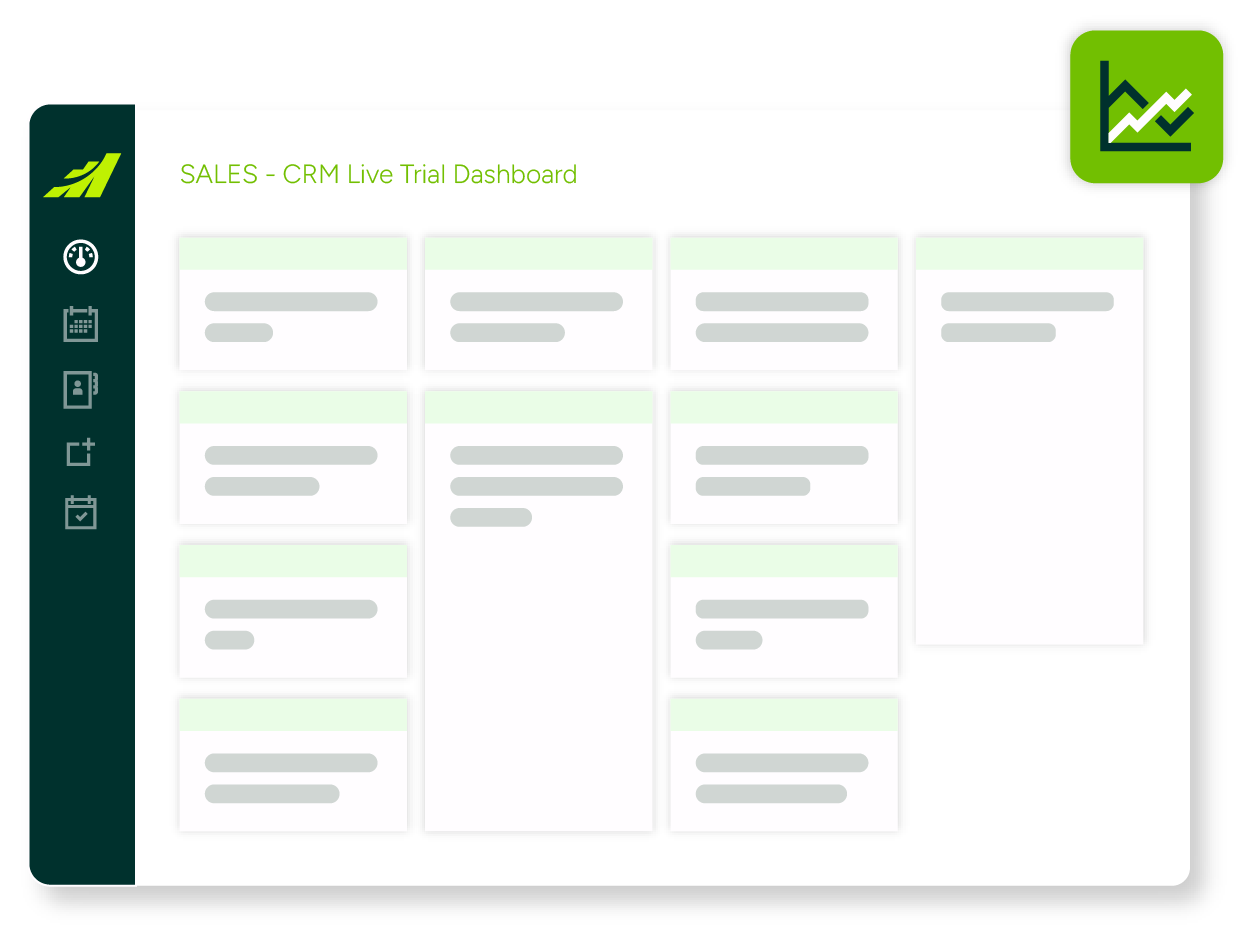

FA Intelligence

- Track advisor activity vs. targets to understand productivity and capacity.

- Analyze your book of business by assets under management (AUM), household, or product mix.

- Surface upcoming KYC reviews, renewals, and life events to stay proactive.

Result: firms gain visibility, advisors gain focus.

Insights Module

Turn client and operational data into actionable intelligence.

- View growth trends, client segments, and relationship depth at a glance.

- Identify cross-sell and intergenerational wealth opportunities.

- Spot compliance gaps before they become issues.

Result: data you can trust, insights you can act on.

Advanced Reporting & Analytics

- Build customized dashboards for executives, compliance, or advisors.

- Track revenue drivers, service levels, and pipeline progress.

- Export audit-ready data instantly. No spreadsheets required.

Result: transparency across every level of your organization.

Activity Tracker

A unified view of every interaction.

- Log calls, meetings, and follow-ups from Outlook or mobile.

- Filter by advisor, branch, or activity type.

- Receive alerts for overdue tasks and upcoming reviews.

Result: complete records and reliable follow-through firm wide.

A platform that works the way financial professionals do

Gain full visibility into your client acquisition and retention process

See your funnel from prospect to long-term client.

Spot what’s working, fix what’s not, and drive measurable growth across your network.

Personalized Client Journeys

Track life events and milestones to offer timely, relevant recommendations.

Automate follow-ups based on interaction history and preferences.

Anticipate needs before clients ask, from retirement milestones to renewals.

Real-Time Performance Tracking

Forecast revenue and monitor activity in configurable dashboards.

Set and track KPIs that matter: appointments, AUM growth, client satisfaction.

Turn data into opportunity by recognizing emerging trends early.

Simplified Security & Compliance Management

Built-in compliance dashboards and KYC review tracking.

Secure document storage with encryption and role-based access.

Automated audit logs and reporting tools aligned with financial regulators’ requirements.

Purpose-built for the way Canadian firms work

Customization without Complexity

Canadian Data Sovereignty & Compliance

Your data stays in Canadian data centres, aligned with financial regulators’ guidelines and privacy standards.

Centralized Task Management & Client Servicing

Companies choose to partner with Maximizer

Best in class CRM software

Over 35 years of delivering exceptional results.

Learn why people love Maximizer

When the ‘Safe Bet’ Is Really Technical Debt

There was a time when choosing Salesforce was the safest move a CTO could make. It was established CRM technology and adaptable to any industry (for a price). Salesforce was the perceived leader...

Wealthbox CRM competitors & best alternatives for 2026

Why look for a Wealthbox CRM alternative in 2026? Advisors reassess their CRM needs as client expectations, compliance rules, and pricing models evolve. In 2026, firms want deeper reporting, better...

Where Advisory Teams Lose Time and How to Get It Back

Some advisory days feel like they run in a straight line. The morning review connects to portfolio notes, the insurance update makes sense in context, and the conversation later in the day draws...

Proven partner for

financial professionals

Trusted by wealth management firms, credit unions, and insurance networks across Canada to deliver performance, compliance confidence, and growth.